We are all surrounded by AI technologies and machine learning. From smart devices in our homes, gadgets on online shopping sites, search engines, self-driving vehicles, and even thermal imaging at airports to fight against Covid-19, it’s everywhere. Likewise, financial institutions have now adopted the use of AI in many areas of their services. This includes wealth management, which requires the most privileged service and personal consultation, and is known to follow traditional ways in its services.

However, the latest integration of artificial intelligence, robo-advisors, has already begun to revolutionize the field of wealth management. Many people may still have doubts about these intelligent robots that imitate human intelligence and go far beyond its capabilities. Yet, the use of robo-advisory technology is continuously increasing every single day, especially by new generation customers, as it provides both speed and efficiency in boosting return on investment.

On the other hand, it is also very attractive for financial institutions, wealth managers and consultants to use this fintech strategy to provide the best quality service for their clients and to offer the best financial plans for an enhanced customer experience.

Understanding the Shift in Wealth Management

Wealth management is a financial area where customers are expecting highly exclusive service, close personal contact, detailed consultation and interest. In order to provide this privileged and individualized service, each wealth manager deals with a portfolio of up to 50 clients. The client base in the field of wealth management is generally individuals aged 55 and over.

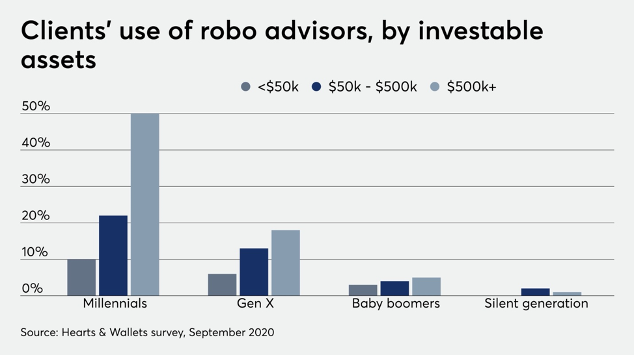

It was possible to define wealth management customers as baby boomers and X generation until now. Therefore, all services in the field of wealth management have been shaped by this audience’s understanding of exclusivityand the search for individual contact away from technology.

However, wealth management, like all other financial services, has undergone a major change recently, with the new generation of customers and technologies such as robo-advisory.

Robo-Advisory in Wealth Management

So what is robo-advisory in wealth management? To put it simply, robo-advisors are software services that allow clients to manage their investments and financial planning services without any human touch and any financial advisor input. Robo-advisory offers an algorithm-based system where the customer is placed at the core and the technology evolves according to customer expectations and needs. Thus, the portfolio management advice that robo-advisors provide is always created with client-centric thinking.

Therefore, this generation of tech-savvy successors, whose expectations have been shaped by technology companies such as Google and Amazon, will surely continue to benefit from the tools and services provided by the robo-advisor to manage their ever-growing assets in the long run. According to data from Business Insider, robo-advisors are expected to create $4.6 trillion in assets under their management by 2022.

Benefits of Robo-Advisors

At first glance, it was thought that the biggest benefit of robo-advisors was that they offered reliable and affordable financial advice to everyone, regardless of their net worth. However, as robo-advisors developed with the contributions of artificial intelligence, they started to provide the following advantages to the industry:

Cost-Effectiveness

Robo-advisors eliminate human labour and therefore commissions, resulting in lower fees. They also offer a more cost-effective approach and strategy for investments. And here is how:

- First, they gather information about the financial status, investment objectives and interests of the customers.

- Afterwards, the software lists the appropriate financial solutions based on the algorithm determined according to the information it collects. These features can be goal planning, automated asset investing, digital advice, retirement planning, tax-loss harvesting, account service or investor profiling.

- After funds are invested, the client’s portfolio is automatically rebalanced to align with the desired target allocation.

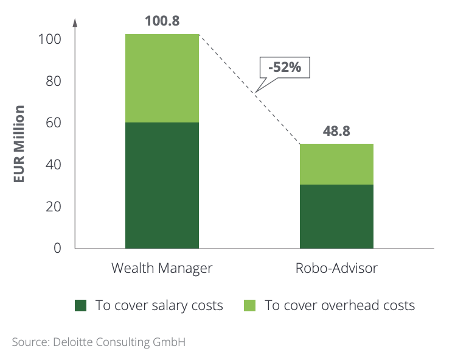

In addition, as Deloitte points out, with robo-advisory, financial institutions have the potential of saving costs in personnel, operating expenses and digitization. Among all, the highest wages in traditional wealth management are salaries and other personnel-related expenses. Robo-advisory significantly reduces personnel costs by optimizing and automating processes, as well as minimizing the need for human effort. Here are the required assets compared in the classic wealth management and robo-advisor model under management per advisor to cover costs:

Competitive Advantage

Wealth management is a highly competitive financial field. With the participation of fintech companies in the sector by providing financial services to potential customers, the competition between financial institutions has intensified. Therefore, in order to stay competitive, the use of digital elements that increase accessibility and ease of use has now become a necessity.

Being able to offer technological solutions to customers prone to switching wealth management providers enables you to stay ahead of the competition and increase both existing customer retention and new customer acquisition.

This new online asset management service system also automates portfolio management and makes it more convenient, cost-effective and accessible. Thus, it appeals not only to the wealthy but also to the general population and provides them with opportunities and personalized services, enabling them to step into the world of investment. In addition, robo-advisors enable high-net-worth (HNW) clients to become more digitally savvy, thereby increasing earnings for financial institutions.

Fraud Reduction and Profile Verification

For financial institutions, trust, accuracy, compliance and success are only possible by designing error-free processes. In services with AI infrastructure such as robo-advisor, human error is eliminated and therefore the possibility of deviation is minimized.

Machine learning used in robo-advisory also makes it possible to easily collect and monitor customer data without the need for any manual input. Thus, if there is any irregular activity, the system automatically detects this and efficiently investigates the fraudulent process.

Enhanced Portfolio Management and Transparency

For the most secure and strategic portfolio management, a robo-advisor examines the client’s goals and financial situation. Based on the results of this analysis, it selects the optimum investment portfolio in line with the determined algorithms. It provides secure portfolio management with high-efficiency investment management by rebalancing the asset allocation with its algorithmic and automatic investment solutions.

Here, with the contribution of artificial intelligence, the customer can easily learn about each of their investments and their performance. They can analyze the concrete facts in a transparent way before making a decision and make the right investment decisions according to their investment goals in a reliable and most understandable way. This makes life easier for new investors as they can get broader and more comprehensive advice.

Conclusion

Wealth management companies must rapidly shape how they can best implement this new technology to take advantage of the conveniences provided by robo-advisors. It should be noted that even customers who still expect human interaction have begun to see the power of artificial intelligence in processes with a high risk of human error. Therefore, it is significant to catch the wind of the digital revolution before it’s too late in order to stay strong among the competition.