Last year marked a turning point in human history. Significant developments have been witnessed in all aspects of our lives, and its effects still continue to generate new transformation areas around the globe. Undoubtedly, the biggest and most remarkable of these developments is happening in the digital transformation landscape.

Triggered by the global pandemic, the quarantine measures taken accordingly and the increasing interest in blockchain and cryptocurrency, today, the issue of creating a digital presence and a digital asset has gained a major importance for both individuals and businesses.

Although a perception was created with innovative technologies such as augmented reality, VR headset technology and the concept of the virtual world, the “Metaverse”, which entered many of our lives rapidly with Facebook’s rebranding, became the last striking point of digitalization. As in many other areas, this virtual space has made finance innovators hungry on how fintechs and new fintech solutions can provide financial services to this brand new world.

What Exactly Is This Metaverse?

“Meta” means beyond. So metaverse basically promises a universe beyond the real world as we know it, which is based on blockchain technologies. It’s a place where virtual reality, real world and augmented reality share the space. While this new universe is still in the ideation stage, it is certain that it will be shaped by the collaboration of new, upcoming innovations and currently pioneering digital technologies.

To add some vision, we can list a few features and characteristics of Metaverse as follows:

- It will exist regardless of time and space.

- While the participants interact in the virtual world, they will be interacting simultaneously in the physical environment.

- It will be an inclusive and accessible platform. Anyone who has a connection can log in at the same time.

- As a continuation of the cryptocurrency, participants and even businesses will be able to transact through a new value chain which will be recognised by others.

So, What is the Connection Between Virtual Space and Fintech?

Although it seems that there will be a focus on virtual reality, digital assets, blockchain, crypto and most commonly, video games, in fact, the metaverse will offer much more comprehensive and endless opportunities for many industries. Metaverse is expected to become an important digital platform for both personal and business interactions, including finance.

In fact, it is believed that financial data management and the methods of managing financial transactions provided with fintech solutions that will be equal to real life will be the most important indicator of making the metaverse as indispensable as real life.

Imagine a virtual world where buildings, objects, clothes, land or avatars can be bought and sold just like in the real world, or where it is possible to walk around the buildings and participate in events in the virtual environment. That means a huge economic ecosystem.

There are even financial players who enter the meta world in a rapid manner to be able to position themselves as the pioneers of the future of digital finance. As the Korea Times noted in August 2021, brokerages and banks in Korea have already begun to create active virtual environments for their clients.

Technologies That Will Shape the Finance Industry in Virtual World

In the Finance 4.0 era, we all know that the aim is to make financial services as invisible and accessible as possible. This is exactly what Amazon does with e-commerce today, or what Google does with information. Metaverse, on the other hand, offers a whole new reality to all of these financial services landscapes.

Now, let’s talk about the leading financial services and technologies that have pioneered the formation of the meta-reality world and will surely continue to influence the future of finance:

Blockchain Technology

Where there is mankind and the assets it creates, whether it is real assets or digital assets, economic dynamics begin to emerge and the need for money begins to arise. Thus, Cryptocurrency is the money that enables financial transactions in the virtual world.

Transactions in the virtual world are carried out instantly and securely with the blockchain technology behind the cryptocurrency. Blockchain technology is also used to write smart contracts, and is also used as a public ledger that establishes who owns what in terms of digital assets.

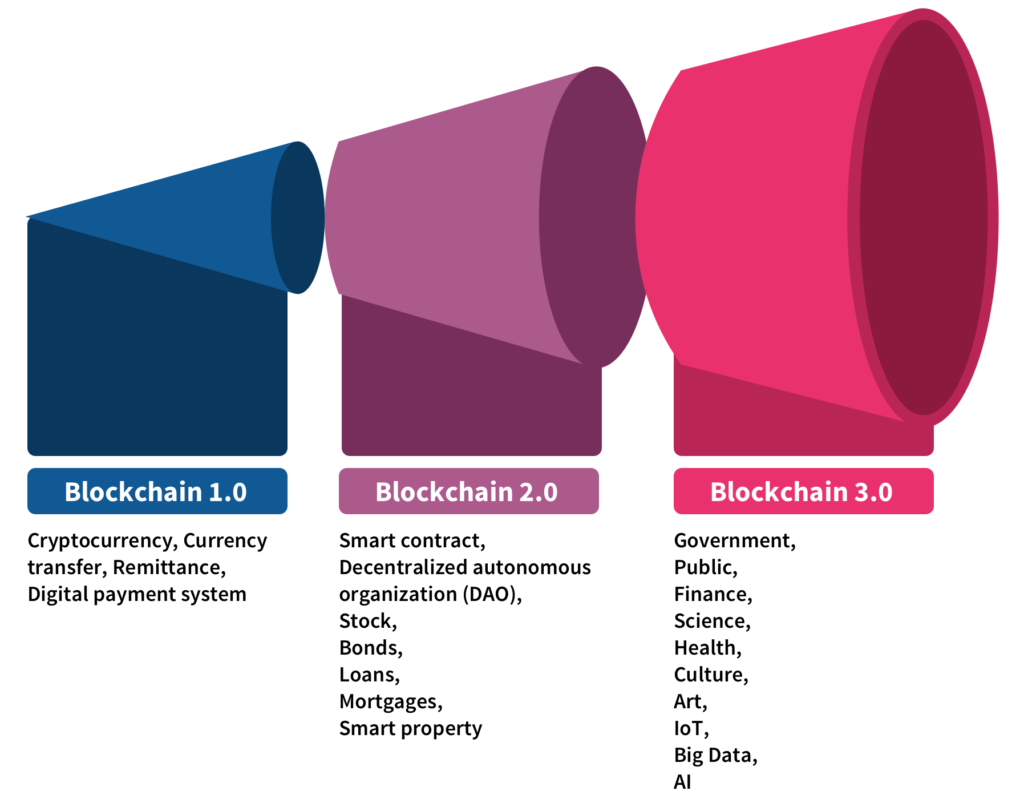

Blockchain 1.0 simply consisted of blocks containing data and a chain linking these blocks. Today, in the era of Blockchain 3.0, it is possible to see blockchain technology in many different fields, as in the financial industry. In the metaverse world, artificial intelligence and blockchain technologies are expected to come up with new applications.

Let’s have a look at a brief overview of the evolution of blockchain technology:

Metaverse Wallets

The most powerful social network, Facebook, with its new name Meta, has already invested $50M in funding non-profit groups to fuel the ‘build the metaverse responsibility’.

So as being one of the first big technology companies to embrace meta reality, it’s clear that Facebook hasn’t just changed its name. With the new Digital Wallet technology it introduced as Novi, Facebook seems to have made its attempts to stay in the game in the field of financial services as well.

In fact, digital wallets, blockchain wallets and metaverse wallets offer the same features. Metaverse wallets only have a few features beyond others. They allow users to develop or distribute their digital assets by receiving, storing or transferring tokens. At the same time, they can accumulate interest by utilizing ETP’s, just like deposits work in physical banks.

Virtual Assistants

Customer interactions are among the things that meta reality will change the most in the world of finance and banking. In fact, Bank of America announced that it will provide virtual reality (VR) training to a total of 4300 employees to keep up with this change.

That means, financial institutions are preparing to take their AI powered virtual assistant services such as chatbot and robo advisory to the next step in order to both adapt to virtual reality and design more flawless customer experiences.

By offering virtual assistants to their customers in the metaverse, financial institutions aim to:

- Navigate challenging topics and conversations

- Strengthen the relationship and bond with customers

- Build more empathetic relationships to gain insights into customers

- Increase customer satisfaction and loyalty by providing fast and effective communication

- Be able to track and record customers’ virtual financial data

How Banks and Other Financial Institutions will Survive

In the virtual world created with Metaverse, the participation of big technology companies in the competition in the financial landscape has completely changed the rules of the game. It is nearly impossible for banks and other traditional financial institutions to stand alone through all the processes that require rapid adaptation and innovative solutions.

It also seems like it will be difficult for them to stay competitive if they don’t make the necessary investments for digital transformation from today. Collaborating with fintechs and benefiting from agile fintech solutions in order to have a presence in this virtual reality, which is still very new and at the ideation stage, will be the fastest shortcut to have a meaningful presence in the meta world.

Fintech is Here to Help

Accelerating digital transformation and creating a strong digital asset from today is the only way to become a strong player in the future of finance.

With 30+ years of financial industry know-how and its dedicated team of experts ForInvest helps institutions to transcend traditional financial solutions and deliver maximum value for customers with innovative technology. Act now to join the next fintech revolution.